Once you’ve narrowed down your potential target market to a specific country and segment, you can start looking for potential buyers! However, not all buyers are the same and you should profile your prospects to increase your selling chances. In this article, we introduce 7 criteria to profile your potential buyers. These criteria will prevent you from wasting time on buyers that are not a good fit and will help you better understand the needs of your prospects.

Before Buyer Profiling

Before you start looking for buyers for your products you should assess whether you are export-ready.

Take our free export readiness self-assessment here.

How to profile the perfect buyer for your products?

Get to know our 7-Multi-Criteria Buyer Profiling method

Finding buyers for your products is not about the perfect product or the perfect buyer, it’s about the perfect match.

It’s neither about quantity of buyers (there are thousands of potential buyers for each product), but about quality (finding the right match for your company). Finding the perfect match requires a good understanding of your offer and the needs of the buyer. To do so you can analyse whether your offer matches the buyer’s needs using these 7 criteria:

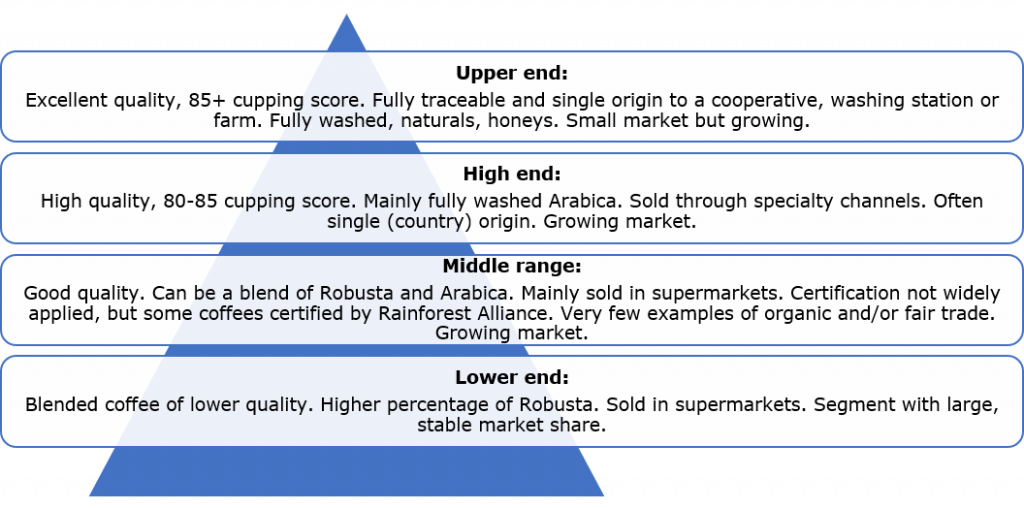

1. Market segmentation:

Is the buyer part of the market segment that you are targeting? Depending on the characteristics of your product you might want to supply your products only to a specific market segment. By doing some research on your potential buyer you can find out if they belong to your target market segment.

Market segmentation for certified coffee in the EU. Source: Prepared by ProFound – Advisers in Development for CBI

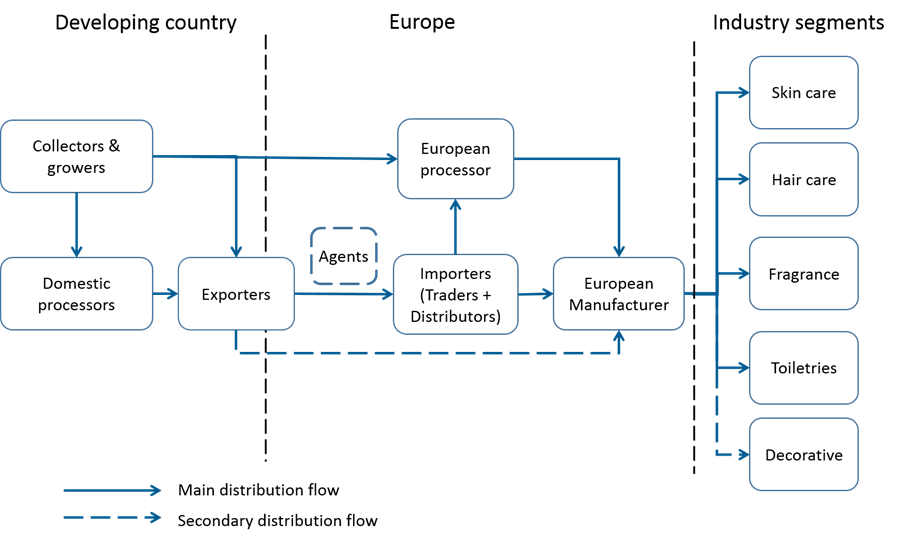

2. Type of company in the distribution network:

Buyers might be located at different points of the distribution network. Different types of buyers may have different requirements. For example, a final product manufacturer may demand additional quality requirements or certifications. Find out what type of company your prospect is and what their main activities are.

Market Channels and Segments for Natural Ingredients for Cosmetics, 2018. Source: ProFound – Advisers in Development

3. Size:

The bigger the buyer, the better? Not really. It might be easy to think that bigger prospects are better as they’re interested in large volumes and have higher budgets. However, supplying to big prospects also means you will need to consistently supply a large volume of your product, at a consistent quality. You need to find a company with volume demands you can meet.

4. Mission (e.g. sustainable or ethical)?

You should find out whether a buyer is concerned about sustainable, organic and/or ethical sourcing, especially if you offer sustainable and/or certified products. If a buyer is looking for sources that match your values (organic, ethical, sustainable, etc), then the more likely they are to engage with you.

The Fair Wild Week from Fair Wild, a niche certification for natural ingredients.

5. Processing and value addition. Raw material or final product?

Find out whether your prospected buyer is interested in sourcing raw materials or processed products. For example, companies that produce botanical extracts may be more interested in raw materials than buying extracts.

Story: Afrigetics’ Pelargonium Sidoides extracts at the Organic Africa Pavilion. Afrigetics specialises in the international supply of African medicinal plants as dried herbs and powder extracts under the guidance of an FSSC22000 accredited quality management system.

6. Level of use. Is the buyer already trading or marketing your ingredient? Is the buyer using similar ingredients?

A good way to estimate the level of knowledge and purchase of a prospective buyer is by finding out their current level of use of the product you offer. Prospects that already buy this product or products for a similar use might be easier to deal with as they understand better the product characteristics and related processes.

7. Competition and comparable offer. Where does the buyer source from?

Finally, you need to understand whether a prospective buyer is already sourcing your product and from where. If a prospect is currently sourcing from a supplier that offers a similar product, you need to find out if your offer has a significant competitive advantage or whether buyers are looking for new/additional sources.

The Organic Africa Pavilion at BioFach. A good way to find out where interesting buyers are getting their products is by visiting a trade fair.

How to apply the 7-Multi-Criteria Buyer Profiling method?

Nowadays, you can find almost all buyer information online. Use your network, databases, websites, and social media profiles to research how these 7 dimensions apply to each prospective buyer. The better fit for each dimension and the more dimensions matched, the better fit for your company. If you cannot find all information online but the company looks promising, make a call to the company or connect through social media to complete your profile.

Looking for buyers?

At ProFound we have more than 30 years of experience matching natural ingredients and agro-biodiverse entrepreneurs with buyers in international markets. Do you want us to help you with a tailored matchmaking service? Get in touch with Nicolás Caso at ncaso@thisisprofound.com.